The relentless pulse of the cryptocurrency market demands more than just brute force. Maximizing Return on Investment (ROI) in mining, particularly within the volatile landscape of Bitcoin and its altcoin brethren, necessitates a strategic symphony of hardware, infrastructure, and astute market navigation. It’s not merely about acquiring the most powerful mining rig; it’s about orchestrating an expert network to optimize every facet of the operation, from electricity costs to hashrate allocation.

At its core, cryptocurrency mining is a computational arms race. Miners, often operating sophisticated “mining farms,” dedicate immense processing power to solving complex cryptographic puzzles, thereby validating transactions and securing the blockchain. The reward? Newly minted cryptocurrency, typically Bitcoin (BTC), Ether (ETH), or Dogecoin (DOGE), depending on the chosen blockchain. But the competition is fierce. The higher the network difficulty, the more computational power required to solve a block, placing immense pressure on operational efficiency.

The allure of digital gold has fueled a surge in demand for specialized mining hardware. Application-Specific Integrated Circuits (ASICs), designed specifically for cryptographic hashing, dominate the Bitcoin mining landscape, offering unparalleled performance compared to general-purpose CPUs or GPUs. In the Ethereum space, while the move to Proof-of-Stake has lessened the reliance on traditional mining rigs, GPU mining continues to be relevant for other cryptocurrencies. Choosing the right “miner” and “mining rig,” understanding its power consumption, and anticipating its lifespan are crucial decisions that impact long-term profitability.

However, raw computational power is only part of the equation. Electricity costs can quickly erode profits, especially in regions with high energy prices. This is where strategic “mining farm” placement becomes paramount. Locations with access to cheap renewable energy sources, such as hydroelectric power in Iceland or wind farms in Texas, offer a significant competitive advantage. Hosting mining machines in these facilities allows miners to leverage economies of scale and minimize operational expenses. Expert network optimization, in this context, means connecting with energy providers, real estate developers, and regulatory specialists to secure favorable terms and navigate the complex landscape of energy infrastructure.

Beyond hardware and energy, understanding the nuances of the cryptocurrency market is essential. The price of Bitcoin, Ethereum, Dogecoin, and other mineable currencies fluctuates wildly, influenced by a myriad of factors, including regulatory announcements, technological advancements, and market sentiment. Miners must continuously monitor market trends, assess risk, and adjust their strategies accordingly. This involves connecting with cryptocurrency analysts, traders, and financial advisors to gain insights into market dynamics and make informed decisions about when to hold, sell, or reinvest mined coins.

Furthermore, the technical aspects of mining require constant attention. Maintaining and optimizing mining rigs, troubleshooting hardware failures, and implementing security measures to protect against cyberattacks are critical tasks. An expert network in this area would include experienced technicians, cybersecurity specialists, and blockchain developers who can provide support and guidance. Regular maintenance, software updates, and vigilant monitoring are essential to maximizing uptime and preventing costly disruptions.

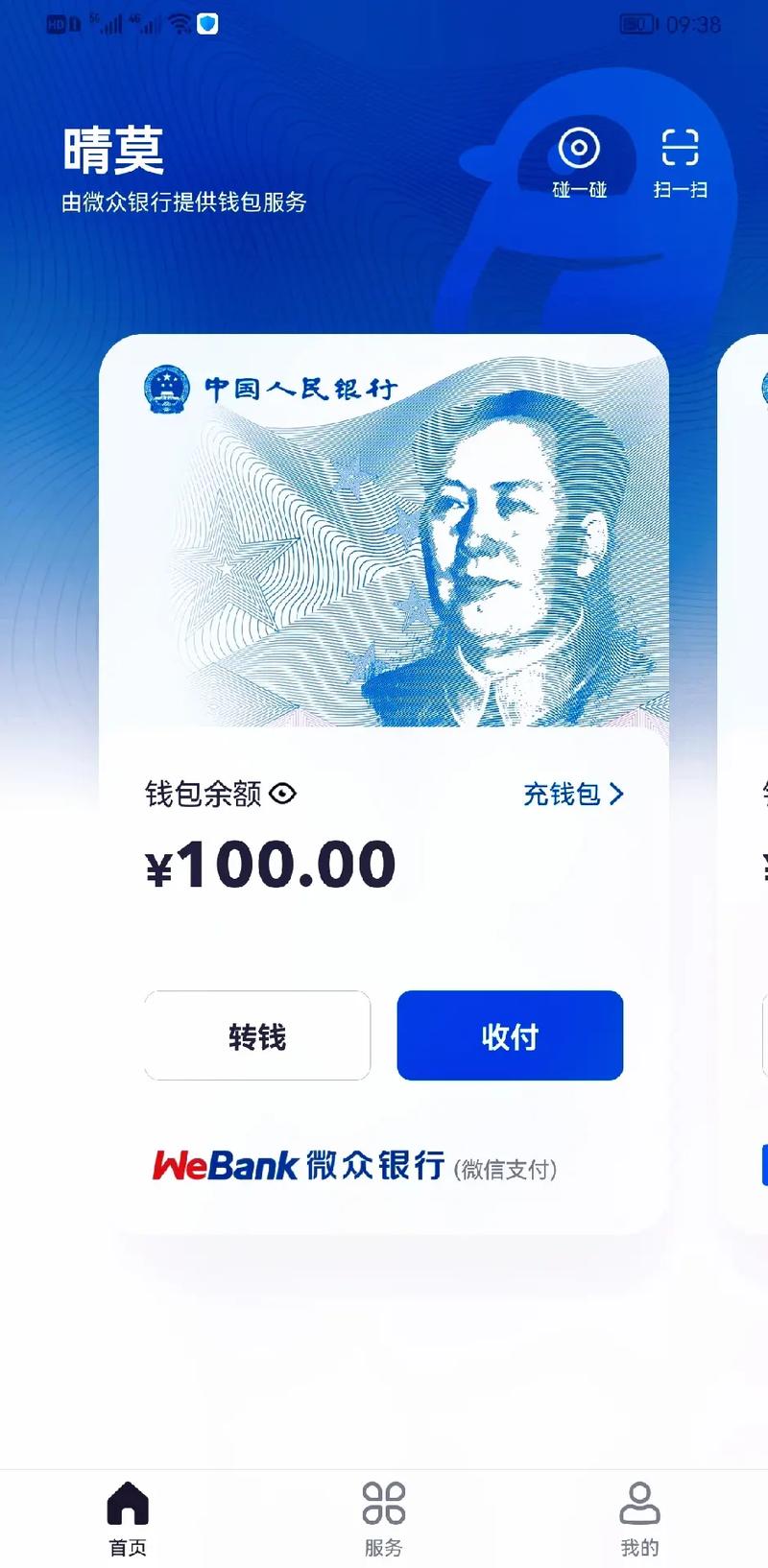

The rise of decentralized finance (DeFi) and other blockchain-based applications has created new opportunities for miners to diversify their income streams. Staking, yield farming, and providing liquidity to decentralized exchanges can generate additional revenue, complementing the rewards from mining. Connecting with DeFi experts and exploring these alternative investment strategies can further enhance ROI and mitigate risk. Understanding the complexities of smart contracts and navigating the evolving landscape of DeFi protocols requires specialized knowledge and expertise.

In conclusion, maximizing ROI in cryptocurrency mining is a multifaceted endeavor that demands a holistic approach. It requires not only investing in the right hardware and securing access to cheap electricity but also building a robust expert network that encompasses energy providers, market analysts, technical specialists, and DeFi experts. By leveraging the collective knowledge and expertise of this network, miners can navigate the challenges of the cryptocurrency market, optimize their operations, and unlock the full potential of their mining investments. The future of mining lies not just in computational power, but in the power of connection, collaboration, and continuous optimization.

Leave a Reply