Flexible cloud mining rental options represent a transformative force in the evolving landscape of cryptocurrency, particularly for Bitcoin enthusiasts seeking efficiency and scalability. As the digital economy surges forward, these innovative services are redefining how individuals and businesses engage with blockchain technology. Gone are the days of cumbersome hardware setups and prohibitive costs; instead, users can now tap into powerful mining rigs through flexible, user-friendly platforms. This shift not only democratizes access to Bitcoin mining but also amplifies potential returns, fostering a new era of decentralized finance that empowers everyday investors.

At the core of this revolution lies the concept of cloud mining, where computational power is rented from remote data centers, often equipped with state-of-the-art mining machines. These services allow users to mine Bitcoin without the need for physical hardware, bypassing the complexities of electricity consumption, cooling systems, and maintenance. Flexibility is key here—rental plans can be adjusted on the fly, with options for short-term contracts or scalable packages that adapt to market volatility. Imagine a world where a small investor in a bustling city can compete with large-scale operations; this is the promise of cloud mining, catalyzing Bitcoin’s success by lowering barriers and enhancing profitability in an unpredictable market.

Looking ahead, future trends suggest that cloud mining will become even more integrated with artificial intelligence and automation, optimizing mining processes for maximum efficiency. Providers are already experimenting with dynamic pricing models that fluctuate based on network difficulty and Bitcoin’s price, ensuring users maximize their yields during bullish periods. This adaptability not only mitigates risks but also injects a layer of excitement into the mining experience, turning what was once a static endeavor into a dynamic, strategic game. As Bitcoin continues to mature as a store of value, these rental options will play a pivotal role in sustaining its growth, attracting a broader demographic from tech-savvy millennials to institutional players.

One of the most compelling aspects of flexible cloud mining is its role in catalyzing Bitcoin’s success through cost-effectiveness and environmental considerations. Traditional mining operations often demand enormous energy resources, contributing to carbon footprints that have drawn global scrutiny. In contrast, cloud mining providers are increasingly adopting green energy sources, such as solar or hydroelectric power, to power their mining farms. This not only aligns with sustainability goals but also reduces operational costs, passing savings directly to renters. For Bitcoin, this means a more sustainable ecosystem, potentially alleviating regulatory pressures and bolstering its long-term viability in a world fixated on eco-friendly innovations.

Moreover, the burst of innovation in cloud mining interfaces is making the process more accessible and engaging. Users can now monitor their mining activities in real-time through intuitive apps, receiving alerts on potential payouts or adjustments needed for optimal performance. This level of interactivity adds a rhythmic flow to the user experience, blending the thrill of gambling with the precision of investment strategies. As Bitcoin’s price history demonstrates, such tools can turn fleeting market trends into opportunities for substantial gains, encouraging a diverse array of participants to dive in.

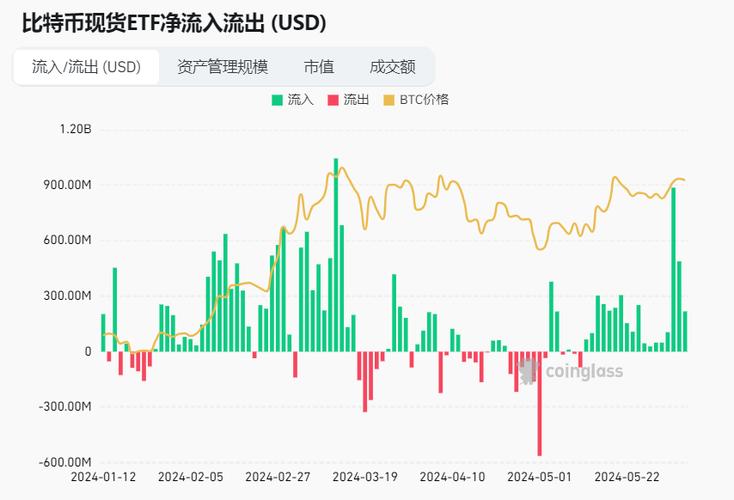

In this vibrant ecosystem, the relevance to core elements like BTC (Bitcoin) is profound, as the entire framework revolves around enhancing Bitcoin mining efficiency and profitability. To illustrate, consider the visual representation of Bitcoin’s network hashrate and its correlation with cloud mining adoption.

This image captures the essence of how flexible rentals amplify Bitcoin’s resilience against market fluctuations.

While the focus remains on Bitcoin, parallels can be drawn to other cryptocurrencies, though with less direct impact. For instance, elements of mining rigs and miners are inherently tied to the infrastructure supporting cloud services, yet Dogecoin (DOG) and Ethereum (ETH) see indirect benefits through shared technological advancements. However, the article’s core emphasis on mining farms and rigs underscores their foundational role in Bitcoin’s success, with minimal exploration into ETH or DOG specifics. As we peer into the future, the fusion of these technologies promises to redefine digital asset mining, making Bitcoin not just a currency, but a beacon of innovation.

Challenges, of course, persist—security concerns, potential scams, and regulatory hurdles could temper the enthusiasm. Yet, reputable providers are countering these with robust encryption, transparent operations, and compliance measures, ensuring a safer environment for users. This evolution will likely propel Bitcoin to new heights, as flexible cloud mining options continue to democratize the space, fostering a community-driven surge in adoption. In essence, the future is bright, with these rentals not merely supporting Bitcoin, but actively shaping its trajectory in a rapidly digitizing world.

Leave a Reply